tax liens in dekalb county georgia

Rollback tax and interest for change of use of. Family Employment Business Bankruptcy Finances Government Products Services Foreclosure Child Support DUIDWI Divorce Probate Contract Property.

Investa Services Of Ga Llc Tax Sale Case Gomez Golomb Law Office

E-Check Fee FREE.

. According to Indiana law a property owner has One 1 year to pay Dekalb County the amount the. Date that taxes imposed the previous year become delinquent if a bill was mailed on or before Jan. However according to state law Tax Deeds Hybrid purchased at an.

Check your Georgia tax liens. This type of lien can be placed by the federal or state government through an authorized agency. BARTOW COUNTY TAX COMMISSIONER Steve Stewart Tax Commissioner Frank Moore Administration and Judicial Building 135 W Cherokee Ave Suite 217A Cartersville Georgia.

A state tax lien also known as a state tax execution is recorded with one or more Clerks of Superior. Cash bank issued cashiers check or bank wire transfer. Debit Credit Fee 235.

Reduce wait times for walk-in service when you join the Same-Day Wait List. Choose Your Legal Category. Once scheduled for a tax sale only the following forms of payment are accepted.

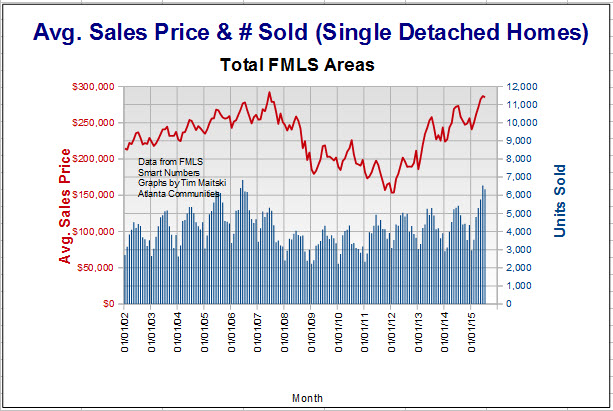

Pursuant to HB1582 the Authority is. DeKalb County Property Appraisal. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate.

All payments are to be made payable to DeKalb. The Property Appraisal Assessment. DeKalb County property tax second installment due Nov.

In fact the rate of return on property tax liens investments in. Search for pending liens issued by the Georgia Department of Revenue. Benton County Cass County Fremont County Greene County Ida County Iowa City Jefferson County Johnson County Marion County.

Clarke County Clayton County DeKalb County. 10 of the current year Secs. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Property Tax OnlinePayment Forms Accepted. A lien is a legal claim to secure a debt and may encumber real or personal property.

Just remember each state has its own bidding process. The sale of Georgia Tax Deeds Hybrid are final and winning bidders are conveyed either a Tax Deed or a Sheriffs Deed. A tax lien in Georgia is a legal claim on a persons real or personal property for unpaid taxes.

Search the Georgia Consolidated Lien Indexes by County book and page. In addition Indiana Tax Lien Certificates are secured by real estate.

Delinquent Property Tax Dekalb County Ga

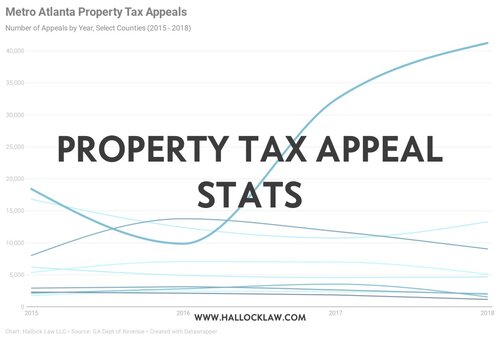

Dekalb County Ga Hallock Law Llc Property Tax Appeals

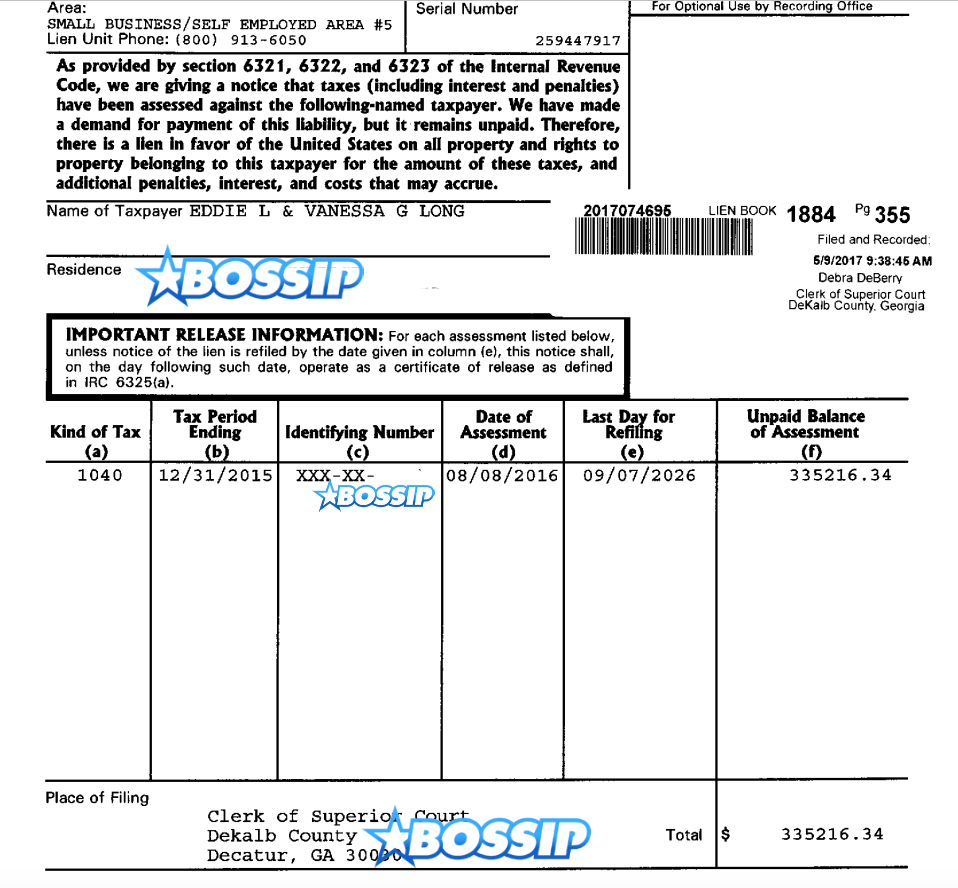

Let The Dead Rest Irs Slaps Bishop Eddie Long With Post Humous Tax Lien

Dekalb County Tax Commissioner S Office 32 Reviews 4380 Memorial Dr Decatur Ga Yelp

Dekalb County Ga Hallock Law Llc Property Tax Appeals

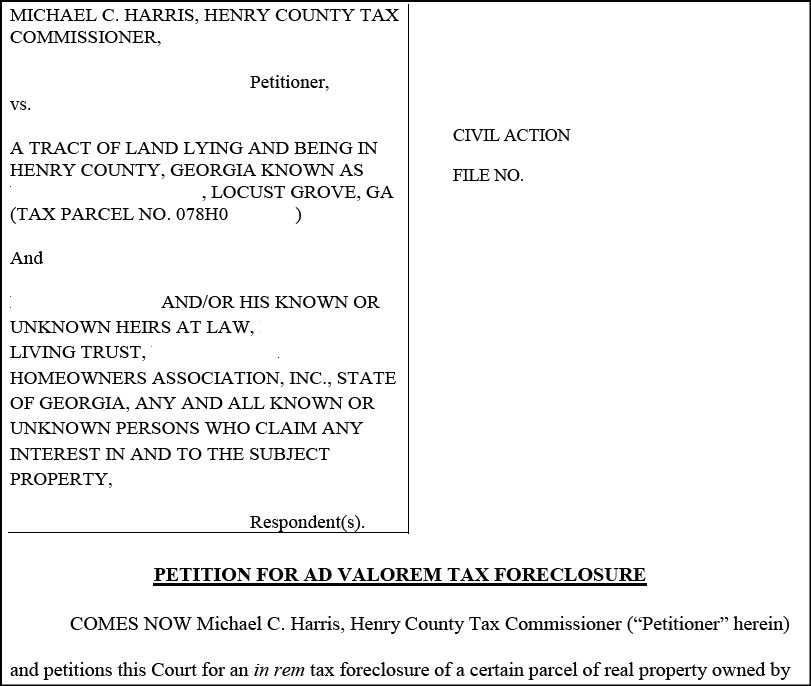

Judicial In Rem Tax Sales Gomez Golomb Law Office

Dekalb County Claim Of Mechanics Lien Form Georgia Deeds Com

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Bid4assets Com Auction Detail 954728 Notice Of Sale Dekalb County Georgia Live Tax Redeemable Deed Sale 116 Redeemable Deeds

Dekalb County Ga Property Data Real Estate Comps Statistics Reports

Northwest Atlanta Ga Cpa Practice For Sale In Dekalb County Georgia Bizbuysell

The Actual Tax Sale In Georgia Gomez Golomb Llc

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

Investing In Georgia S Tax Defaulted Property Auctions